This endpoint to be provided by the Provider to allow ILS to retrieve details about a loan. This will be used during Customer Validation and will be used to synchronize ILS Data with the Providers.

Request Message description

| Field# | Field name | Data type | Max length | Required | Description |

| 1 | loanId | Numeric String | 50 | true | The id of the loan whose status we are trying to retrieve. |

| 2 | channelCode | String | 50 | false | The Code of the Channel from which request is coming from. |

| 3 | customerId | String | 50 | false | Customer Id who the loan belongs to. |

Endpoint

|

GET /endpoint goes here. The Provider is expected to provide this and configured on the ILS Platform.

|

Headers

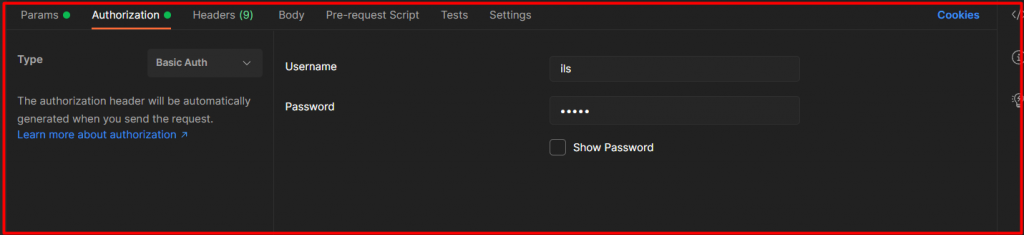

As a Lender, please note that it is expected you have a basic authentication for each API spec. A sample screen shot is shown below.

Sample Request

Sample request

| Field

# |

Field name | Data type | Max length | Required | Description |

| 1 | responseCode | Numeric String | 5 | true | The Code representing the status of the processing of the request. It shows whether the request to accept the offer is allowed or not. |

| 2 | responseMessage | String | 255 | true | The Description of the Response Code from above. |

| 3 | loan | true | An Object containing the details of the loan requested. | ||

| 3a | status | ENUM | True | The Status of the Loan whether it has been paid or not, overdue or not. | |

| 3b | remainingAmount | Long | True | The Amount remaining for the Customer to paid that will make the loan fully paid. | |

| 3c | dueDate | Date Time (UTC) | True | The Date/Time at which the Customer is expected to have paid back the loan. |

Response Message field description

Sample Response (success)

| {“responseCode”: “00”,

“responseMessage”: “Successful”, “loan”: { “status”: “OPEN”, “remainingAmount”: “0.00”, “dueDate”: “2017-06-12T11:46:15Z” } } |

Sample Response (failure)

| {

“responseCode”: “4004”, “responseMessage”: “Unknown offer” } |